Understanding the Real Estate Model in Dubai

The evolution of Dubai’s real estate market represents a unique interplay of innovative design, cultural influences, and modern economic strategies. Known for its luxurious skyline and ambitious projects, Dubai has become a global hub for real estate investment. Understanding the real estate model Dubai offers valuable insights into not only the growth of the city but also the intricacies involved in property development in this vibrant emirate.

Overview of Dubai’s Real Estate Landscape

Dubai’s real estate landscape is characterized by a blend of opulence and functionality, attracting both local and international investors. From futuristic skyscrapers to sprawling luxury villas, the city offers diverse property options. The market poised for continual growth, fueled by innovations in architecture and urban planning, positions Dubai as a desirable destination for both living and investment.

Key Characteristics of Successful Real Estate Models

- Investor-Friendly Regulations: The UAE government has implemented various policies to encourage foreign investment, including ownership in freehold areas.

- Luxury and Lifestyle Appeal: Projects often emphasize lifestyle amenities, targeting high-net-worth individuals seeking a balance of comfort and status.

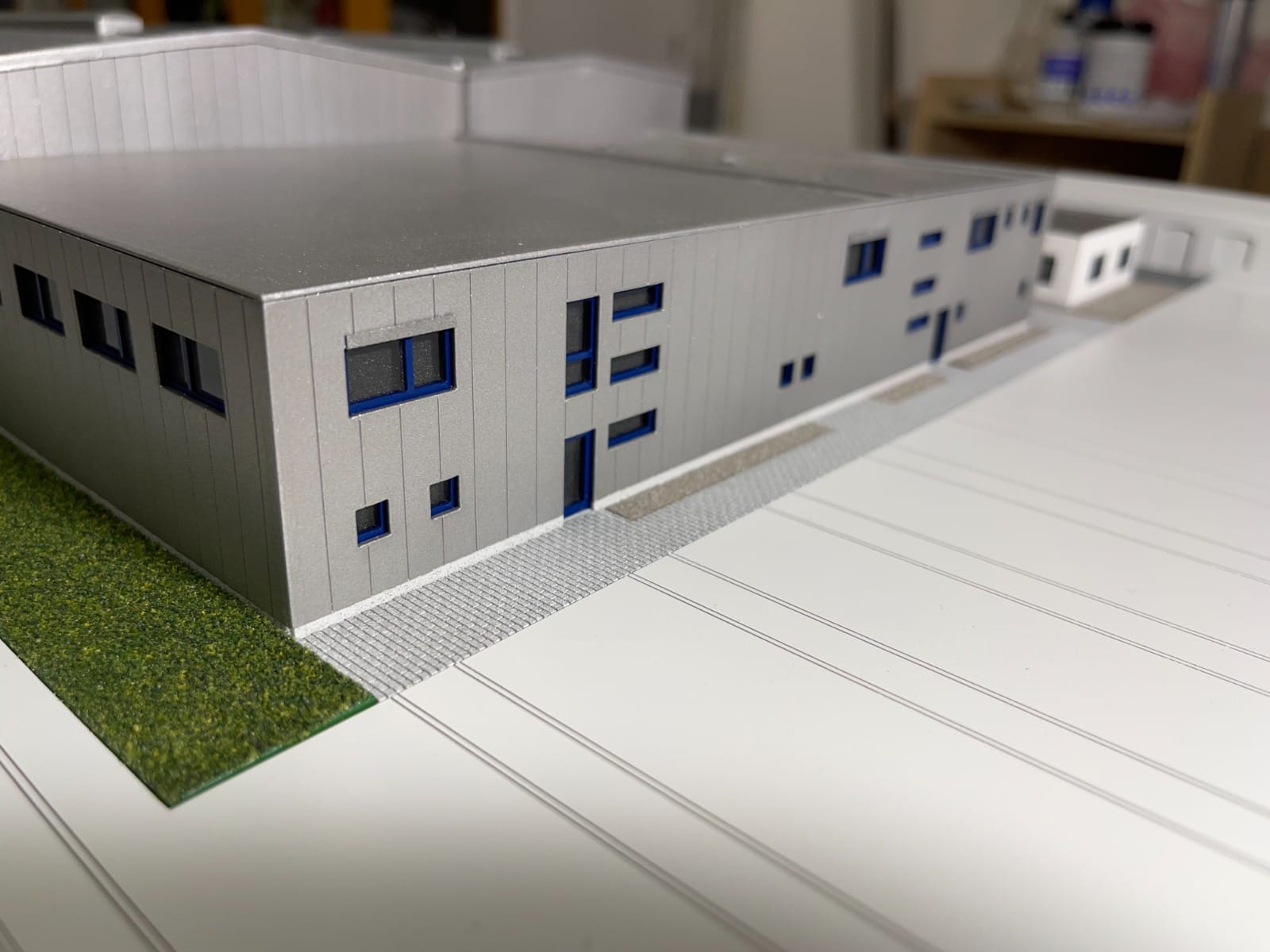

- Innovative Architecture: Architectural designs in Dubai often push the boundaries, infusing cultural elements with modern aesthetics, thus enhancing the visual landscape.

Market Trends Influencing Dubai’s Real Estate Development

Several trends currently shape the real estate market in Dubai:

- Global Economic Shifts: As economies worldwide evolve, Dubai’s strategy has transitioned to align with sustainable practices and digital innovations.

- Smart City Initiatives: The integration of technology in urban management has made Dubai a frontrunner in the development of smart city concepts, enhancing living experiences.

- Sustainability Goals: There is a push towards achieving sustainability in construction, featuring energy-efficient designs and green technologies.

Factors Driving Demand for Real Estate Models in Dubai

Economic Growth and Investment Opportunities

Dubai’s consistent economic growth, even amidst global fluctuations, contributes significantly to its real estate boom. The emirate’s strategic location as a link between the East and West has made it an attractive site for businesses, subsequently driving the demand for residential and commercial properties.

Population Growth and Urbanization Trends

With the UAE’s population steadily increasing, the demand for housing has surged. Urbanization trends indicate a shift toward high-density living in city centers, spearheading developments that accommodate diverse lifestyles.

Tourism and Its Impact on Real Estate Models

As one of the top tourist destinations globally, Dubai’s tourism sector significantly influences its real estate market. Properties located near major attractions or with unique offerings tend to see higher occupancy rates, enhancing their investment viability.

Design and Architecture of Real Estate Models in Dubai

Innovative Architectural Features in Dubai Properties

Cutting-edge architectural features define Dubai’s buildings. From the iconic Burj Khalifa to the surreal structures of the Palm Jumeirah, the designs advocate a synthesis of art and functionality. This emphasis on innovation not only attracts buyers but also represents Dubai’s forward-thinking ethos.

Sustainability Practices in Real Estate Development

In response to global sustainability challenges, Dubai’s real estate sector is embracing greener building practices. Projects are increasingly incorporating renewable energy sources, eco-friendly materials, and efficient waste management systems to meet the rising expectations of environmentally conscious investors.

The Role of Technology in Modern Property Models

Technology plays a pivotal role in transforming the traditional property market into a data-driven ecosystem. Smart homes equipped with Internet of Things (IoT) technologies allow for enhanced security and energy management, making them highly appealing to tech-savvy buyers.

Challenges Faced by Real Estate Models in Dubai

Market Competition and Saturation

The exponential growth of Dubai’s real estate market has led to increased competition. With numerous projects being launched, developers must continuously differentiate their offerings to attract buyers in a saturated market.

Regulatory Challenges in Real Estate Development

Navigating regulatory landscapes can be complex. Developers face challenges regarding compliance with local laws that can affect project timelines and costs. Understanding these regulations is crucial for successful project implementation.

Economic Fluctuations and Their Effects on Investment

Global economic changes can induce fluctuations in real estate demand. Investors must stay attuned to economic indicators and trends, adapting their strategies accordingly to mitigate risk.

Future Prospects for Real Estate Models in Dubai

Emerging Sectors and Investment Areas

Looking ahead, several sectors show promise for growth, including healthcare, education, and entertainment. These emerging areas are likely to shape the next wave of real estate development, creating new investment opportunities for stakeholders.

Predictions for Dubai’s Real Estate Market

Market analysts predict that as Dubai continues to innovate and implement sustainable practices, it will solidify its standing as a premier global real estate destination, attracting both investors and residents alike.

Strategies for Success in a Competitive Landscape

To thrive in Dubai’s competitive real estate market, developers should consider implementing the following strategies:

- Focus on Customer Experience: Offering unique experiences and personalized services can set properties apart and enhance their appeal.

- Use Data Analytics: Leveraging data insights can help identify market trends and consumer preferences, allowing for more informed investment decisions.

- Embrace Sustainability: As environmental awareness rises, properties that prioritize sustainability may attract a premium from investors and buyers.